Economics, Policy and Business within Agriculture, Food, Natural Resources and Environment

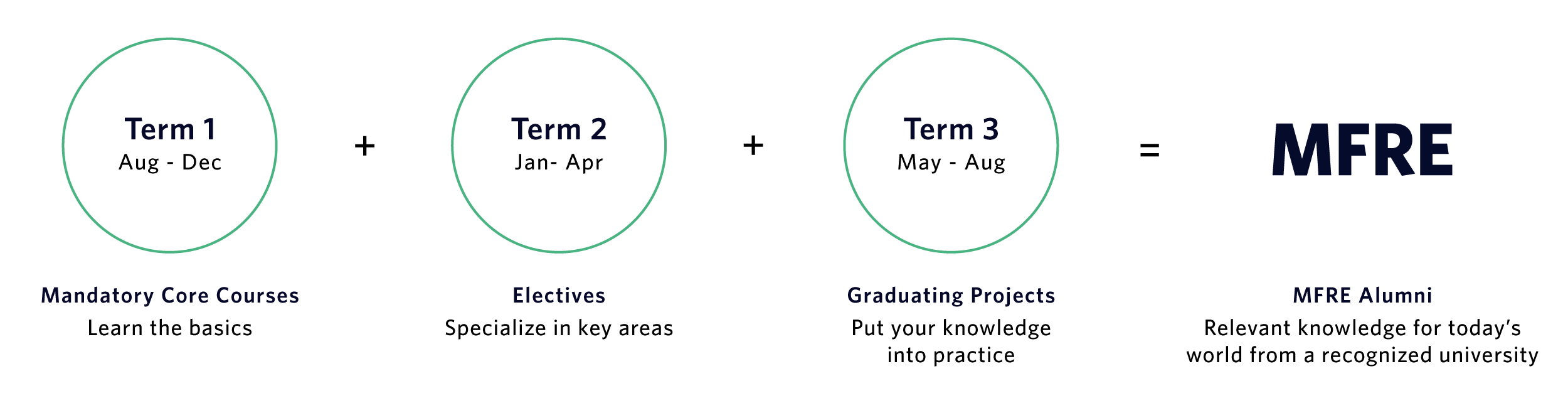

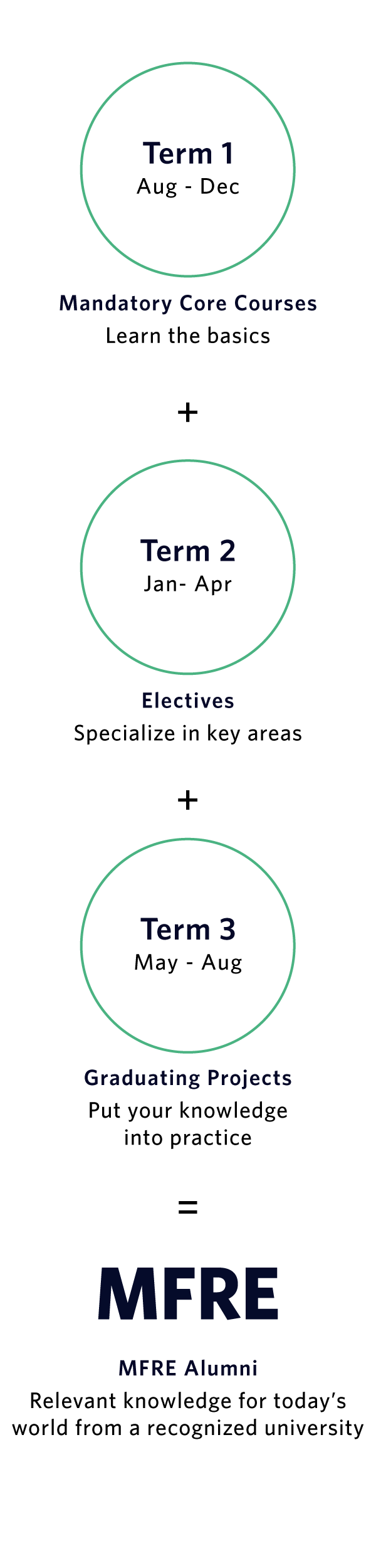

The MFRE is a unique one year professional masters degree combining Economics, Policy and Business seen from an Agriculture, Food, Natural Resources and Environmental perspective. The program is completed over three terms: the first two comprise rigorous courses in multiple specialization areas; in the third one, you will enhance and consolidate your MFRE experience through a summer graduating project. This project can take the form of research, a consultancy project or an internship.